Apply to Accept Online Payments

Complete an online form to accept credit card payments. Approval takes ~5 days. Then patients can pay you online.

Table of contents

- Apply to Accept Online Payments

- How to complete the form for accepting Credit Card payments

- What happens after you apply

- How credit card processing fees work

Apply to Accept Online Payments

- Complete the forms below (Lower down on this page is a "how to" for completing the form.)

To accept online Credit Card payments

Complete this form: banquest.com/arproactive > Get Started

Fees are listed here: banquest.com/arproactive

To accept online eCheck payments

Complete this form: Download form

Fees are listed here: banquest.com/arproactive

- This application is to enable you to accept payments online. You can still keep any other credit card processing account you already have (e.g. your point-of-sale account). (We don't integrate with other merchant accounts, so you will still need to apply for the Banquest.com merchant account above.)

- If you have existing patient's with stored credit cards (e.g. who are on autopay) transfer those patient's details using this spreadsheet, and then contact support@banquest.com to complete the transfer into Banquest.

How to complete the form for accepting Credit Card payments

Step 1. Business info

- Email: where should we send email to confirm your application?

- Date started: when did the company start?

- Date you'd like the account to be live: select 1 week before you plan to accept online payments. (It's recommended not to select over 1 month before, because then you will be needlessly charged a monthly fee.)

- NABP number: or NCPDP number. This is used to waive Visa's fee of $500/year to pharmacies.

- Pharmacy type: ignore if you're not a pharmacy

- Driver's license: this should be same person as on "Step 3. Applicant’s information" below

- Pharmacy license: this can be your state license, or any other showing you're a legitimate pharmacy (ignore if you're not a pharmacy)

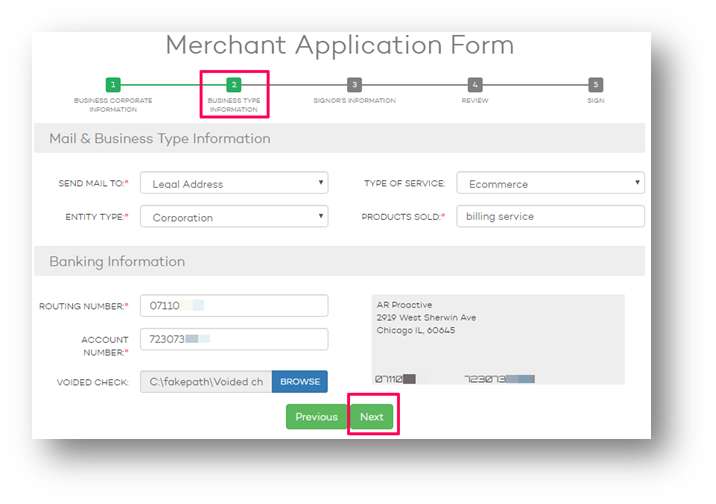

Step 2. Business type

- Entity type: select corporation, LLC or sole proprietor

- Type of service: select “Ecommerce” because you’re accepting payments mostly online

- Products sold: select "pharmacy" if you're a pharamcy, or your health care niche

- Bank routing num, account num and voided check: where do you want patient payments to be deposited, and fees withdrawn from?

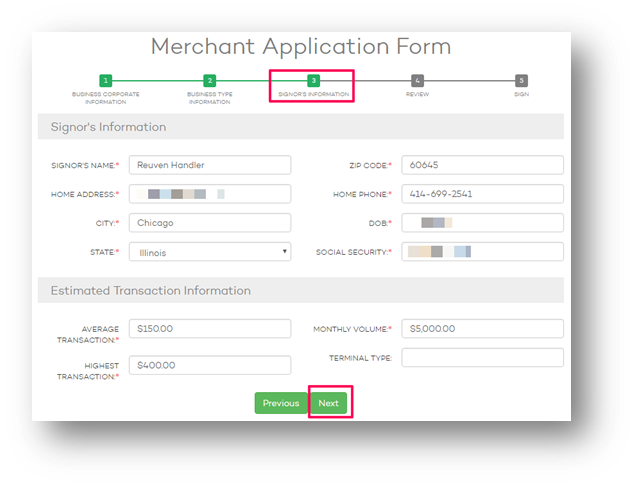

Step 3. Applicant’s information

This information is to confirm the applicant is not involved in fraud or terrorism (post-9/11 rules). Enter the following for one of the owners or manager of the company:

- Home address

- DOB

- Social security

- Average transaction: enter $75, or estimate a typical patient bill

- Highest transaction: enter $400, or estimate what the highest bill might be e.g. $400.

- Monthly volume: enter $4,000 or many credit card payments you expect a month

- Terminal type: leave blank

Step 4. Review - review the form, check the "I accept" box, and click Next

Step 5. Approve in 3 places and click Submit

Step 6. If you’re a Pharmacy, then email Banquest boarding@banquest.com the following:

- The applicant’s driver’s license (used by underwriting to do an anti-fraud check)

- NABP number (used to waive a Visa fee)

- Your LTC (or closed door) pharmacy license, or a screenshot from your website showing that you provide LTC services (used to waive the annual Mastercard $500 fee)

What happens next

- You will get a confirmation email from noreply@elavon.com in about 2-3 business days. You must eSign the email from noreply@elavon.com. (Contact boarding@banquest.com if you don’t get the email.)

- After you're approved you will get a welcome email from boarding@banquest.com with a login to your gateway.

- Finally, you will receive a setup complete email from support@arproactive.com.

- You are now ready to accept online payments!

How credit card processing fees work

- Patients pay you online. Learn more here.

- The full payment amount is deposited to your bank account the next day (for credit card payments).

- At the end of the month, Banquest (or your legacy payment processor) will bill you for the credit card processing fees associated with all the payments you received, according to their fees. Fees listed here: banquest.com/arproactive

For example

- You receive a patient payment of $100 on Jan 1, and another patient payment of $100 on Jan 10.

- You will see deposits in your bank of $100 on Jan 2, and another patient payment of $100 on Jan 11. (Credit card payments are deposited the next day. eCheck payments are deposited in ~5 days.)

- On Feb 1 (or thereafter) you will receive a bill and breakdown from your credit card processor. It may be something like

- Total payments received $200

- Total fees due: (2.89% x $200) + (2 x $0.25) = $6.28

- AR Proactive does not see or know the breakdown of your credit card processing fees. Only Banquest (or your credit card processor) can supply that information.